Grow your business with us, our team works with owners and executives to set up their accounting backoffice, organization structures, prepare financials and tax returns

As Cannabis businesses have unique challenges with Federal regulations such as 280E, partnering with the right business advisor to find the optimal solutions is key.

Right from the start Cannabis owners and executives need to think about the right business structure. Keeping business lines that are non-plant touching as separate companies will help limit the 280E burden, setting up your books to maximize COGS by employing a 471(c) strategy is a must.

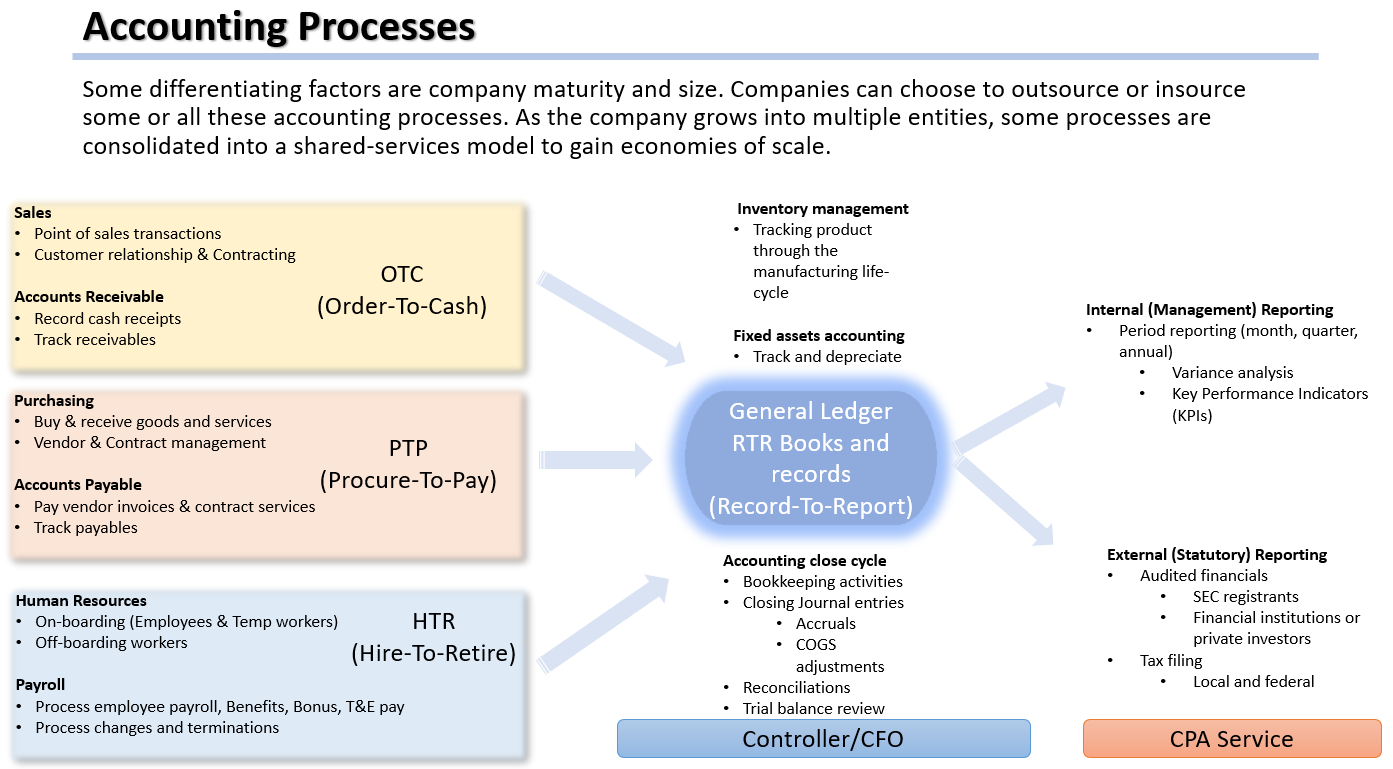

Position your company for growth by setting up processes that can easily scale up. Accounting can be difficult, but it does not have to be messy. Find a Controller/CFO/CPA that understand all aspects of the accounting process.

- Order to Cash

- Procure to Pay

- Hire to Retire

- Record to Report

These are processes that encompass all the business leading to complete books and records.